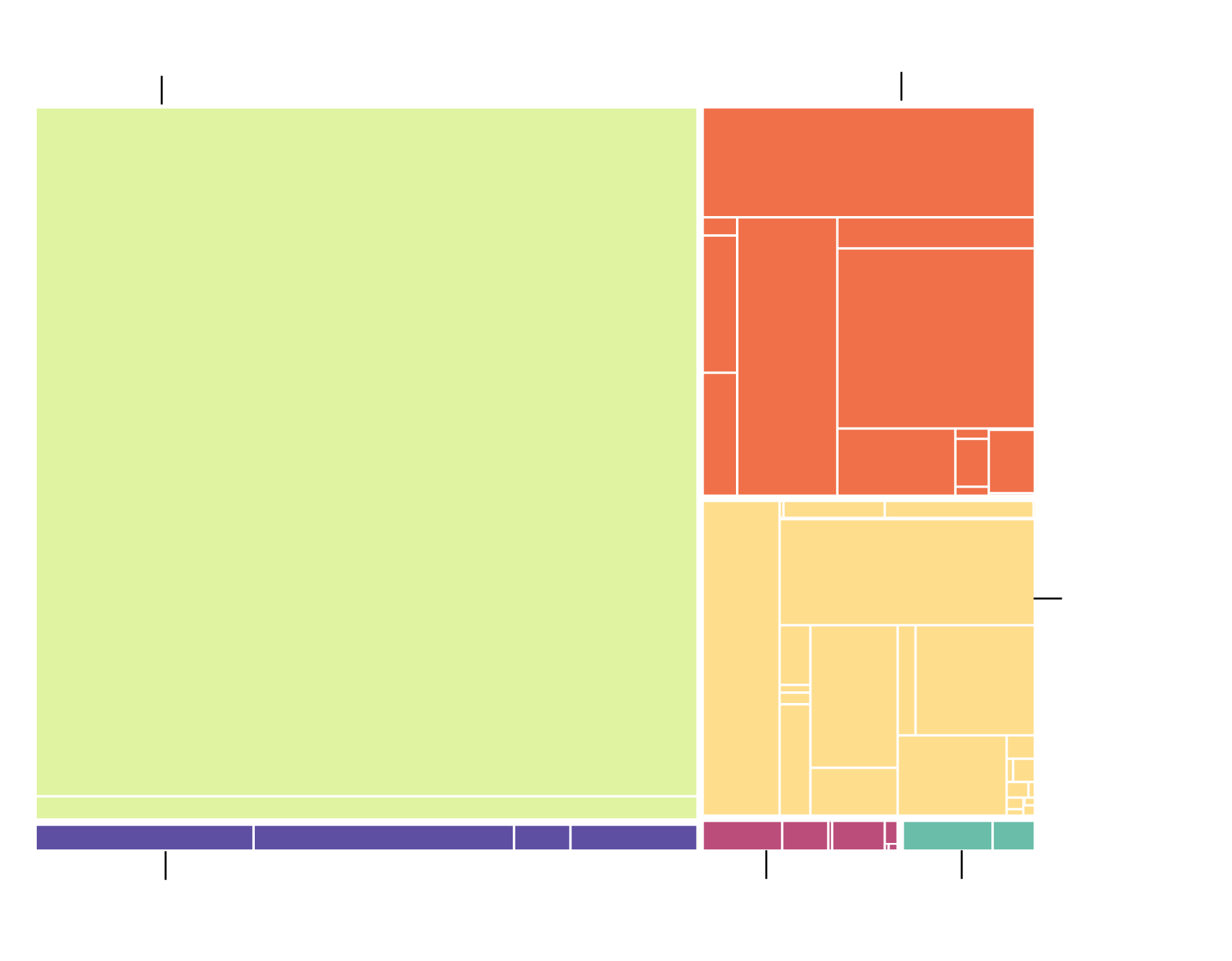

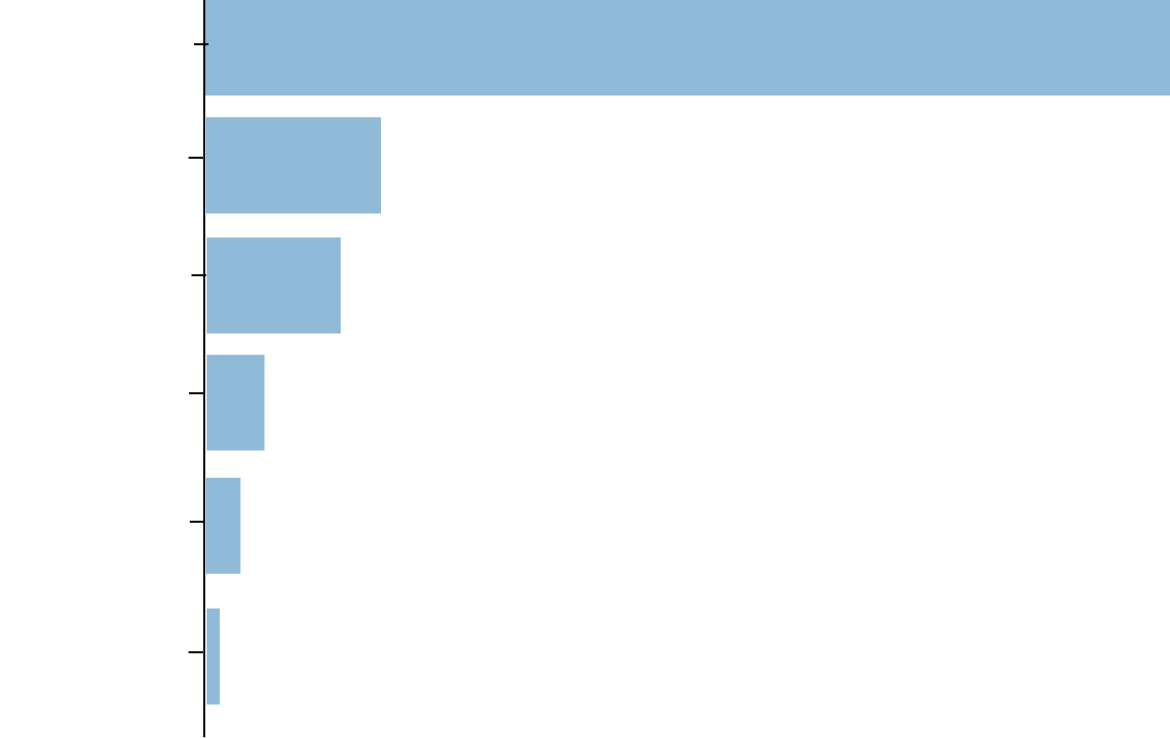

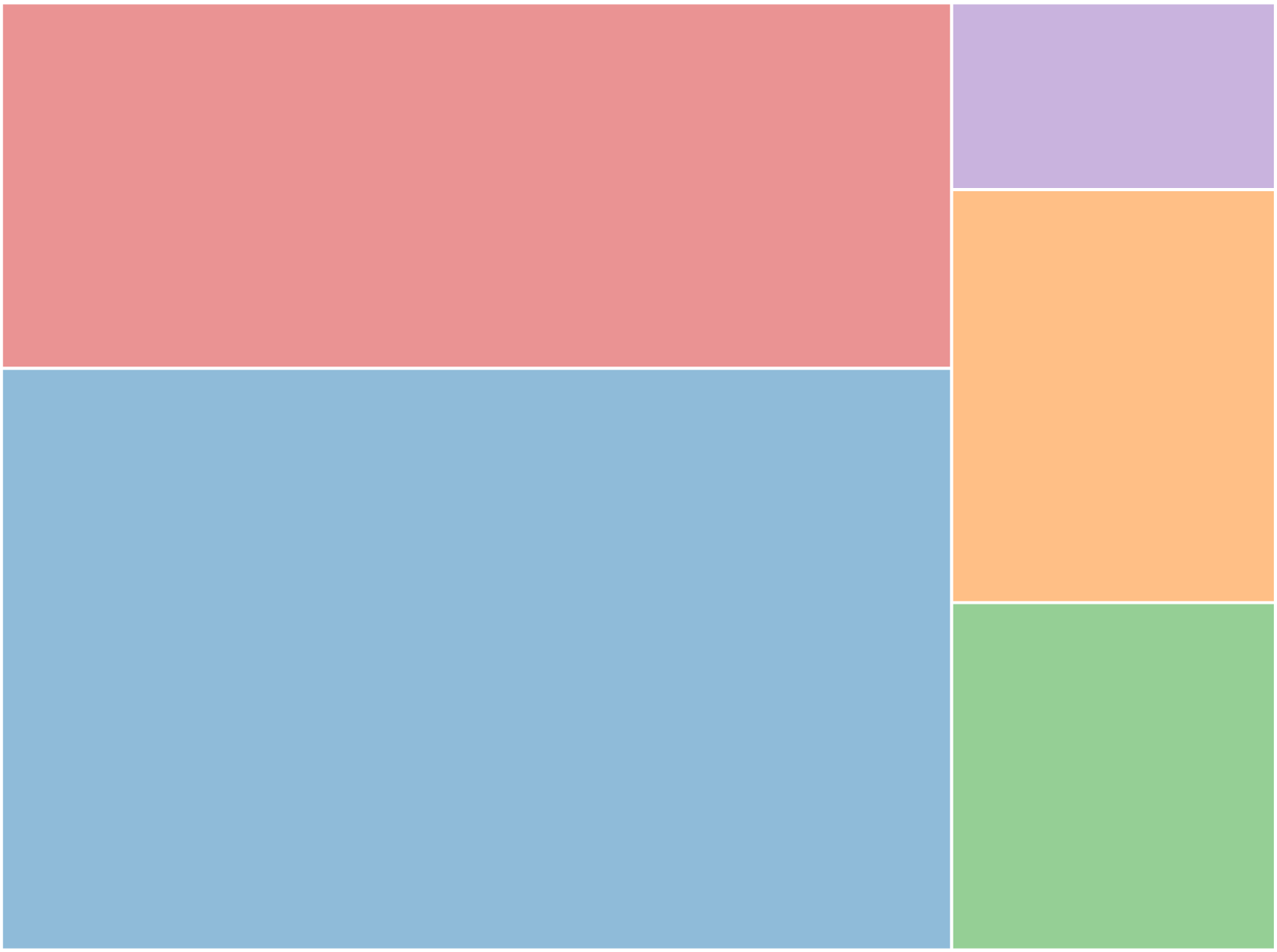

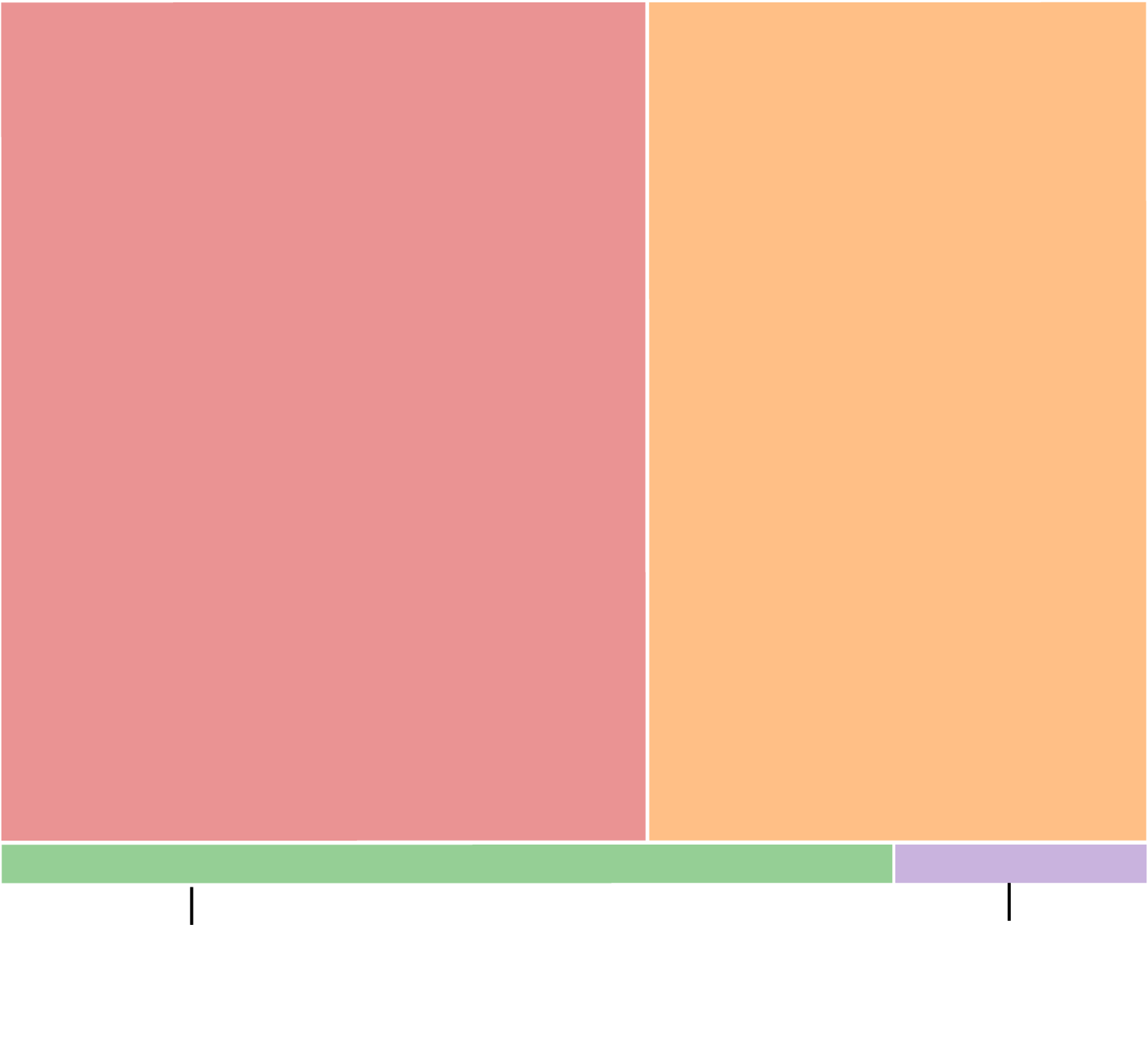

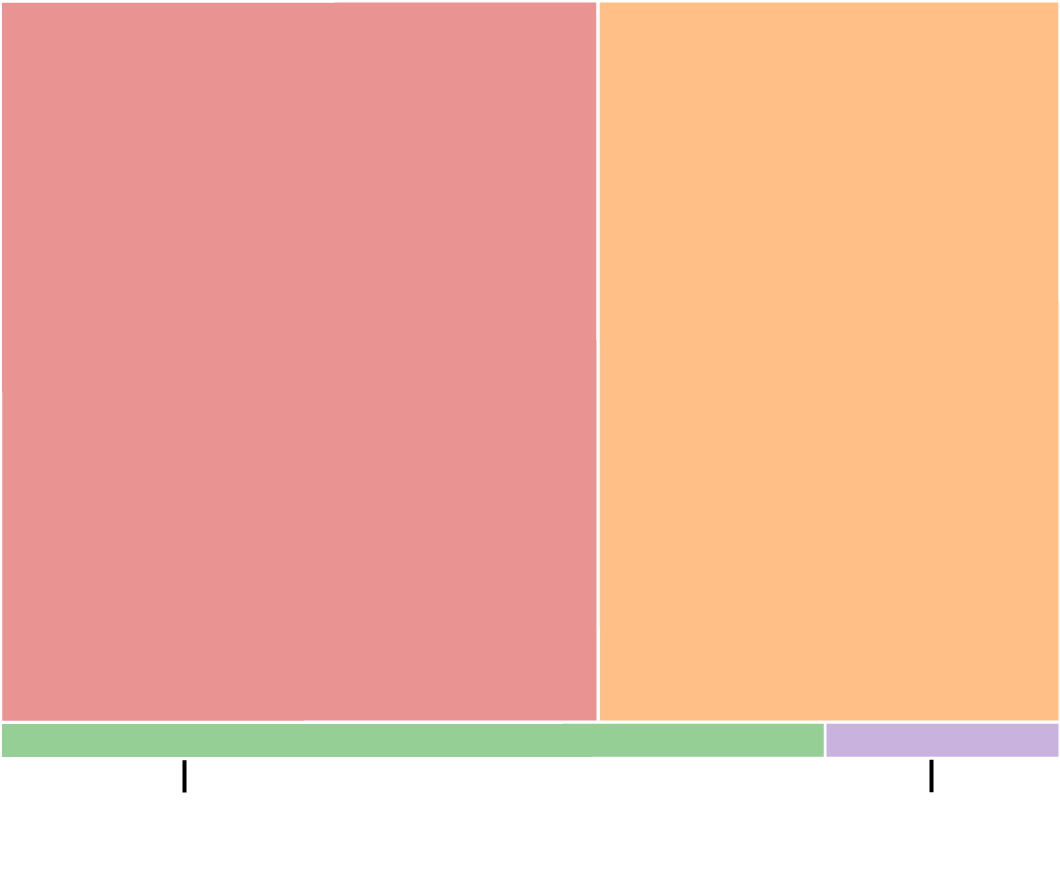

Africa is losing out of global investment in agriculture technology

ASIA

NORTH AMERICA

$6.7 billion

$24.1 billion

India

United States

Indonesia

Israel

China

South Korea

France

Ireland

EUROPE

$5.4 billion

United

United

Germany

Kingdom

Kingdom

Netherlands

Canada

South

Africa

Australia

tralia

Kenya

Nigeria

Chile

Brazil

Colombia

AFRICA

OCEANIA

SOUTH AMERICA

$244 million

354.8 million

$1 billion

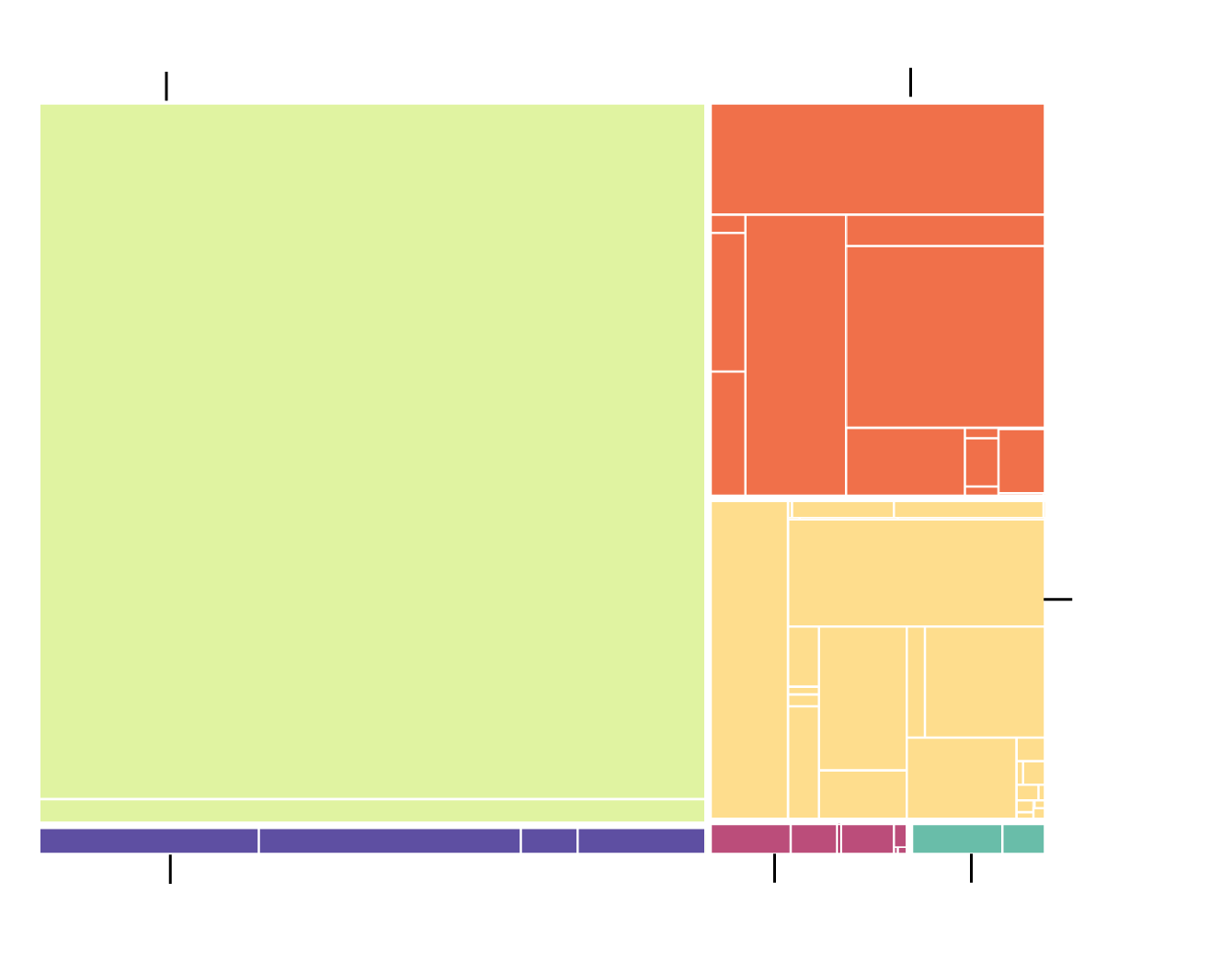

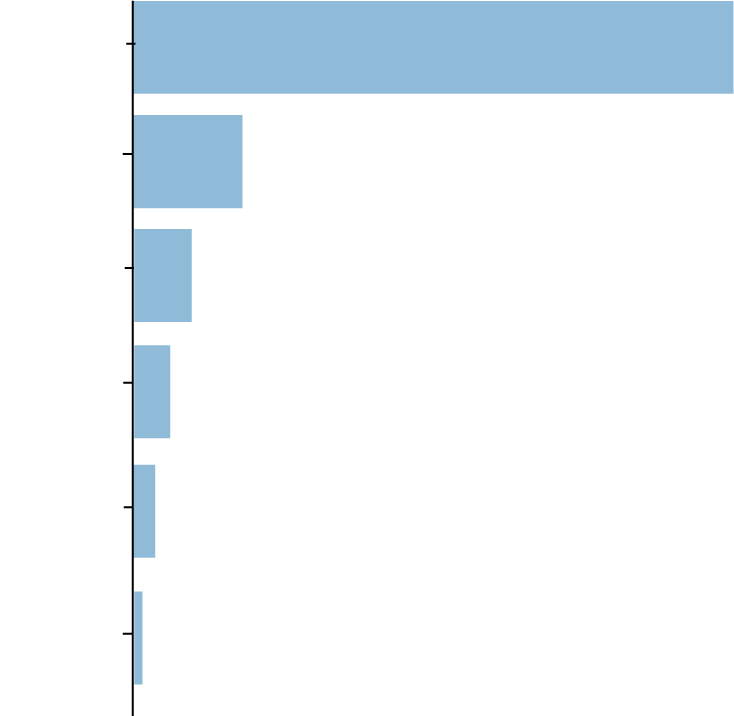

ASIA

NORTH AMERICA

$6.7 billion

$24.1 billion

India

United States

Indonesia

Israel

China

South Korea

France

Ireland

EUROPE

$5.4 billion

United

United

Germany

Kingdom

Kingdom

Netherlands

Canada

South

Africa

Australia

tralia

Kenya

Nigeria

Chile

Brazil

Colombia

AFRICA

OCEANIA

SOUTH AMERICA

$244 million

354.8 million

$1 billion

A fast growing population. Worsening food insecurity problem. 60 per cent of the world's agricultural land and a fast expanding tech ecosytem. All these make Africa a ripe ground for investment in agriculture. But only a small fraction of global investments in agriculture startups are going to the continent.

Investors are backing at least 1,316 agriculture technology startups, according to a database maintained by business analytics platform CBInsights. These startups have attracted at least $37.8 billion in funding.

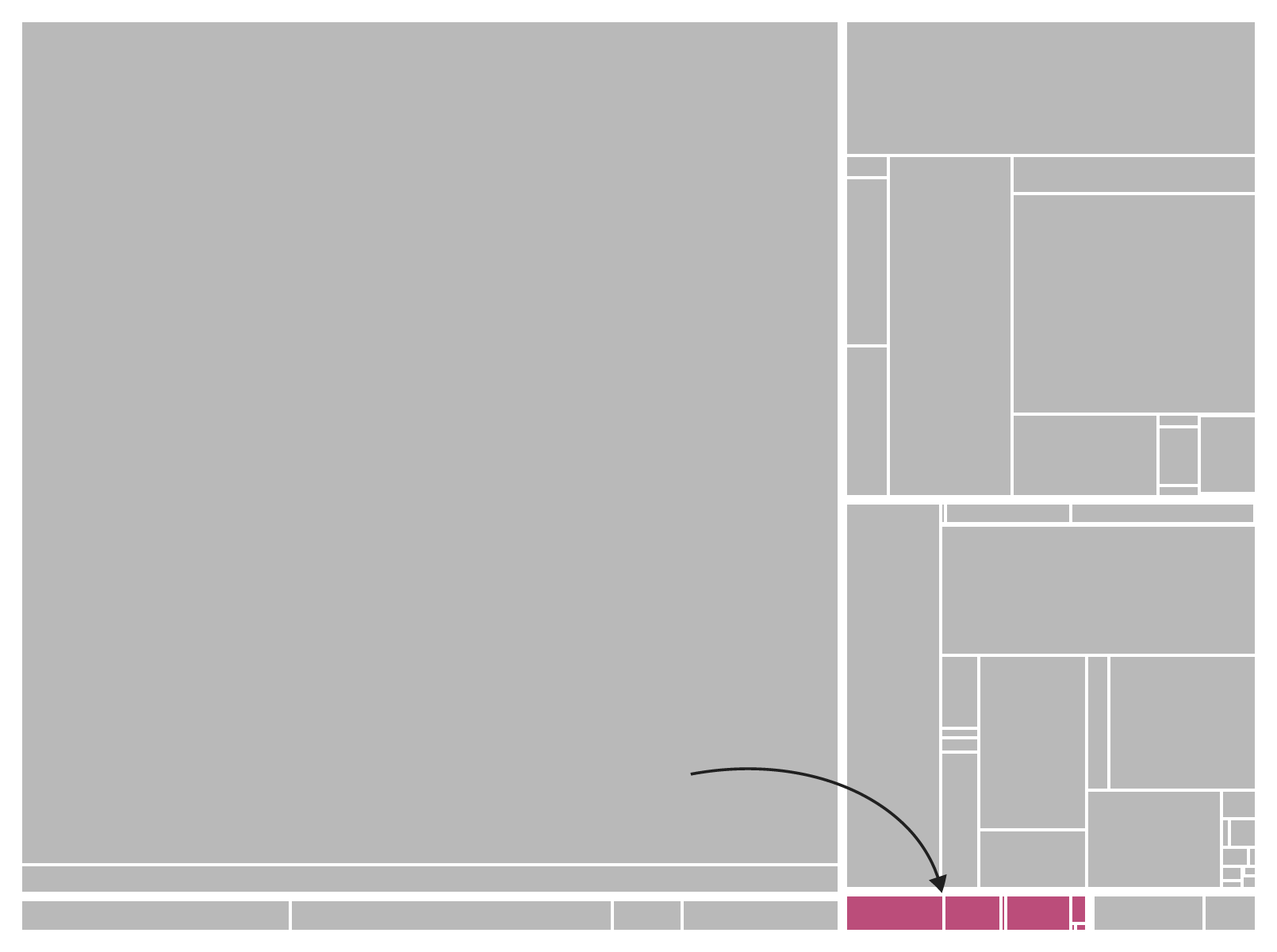

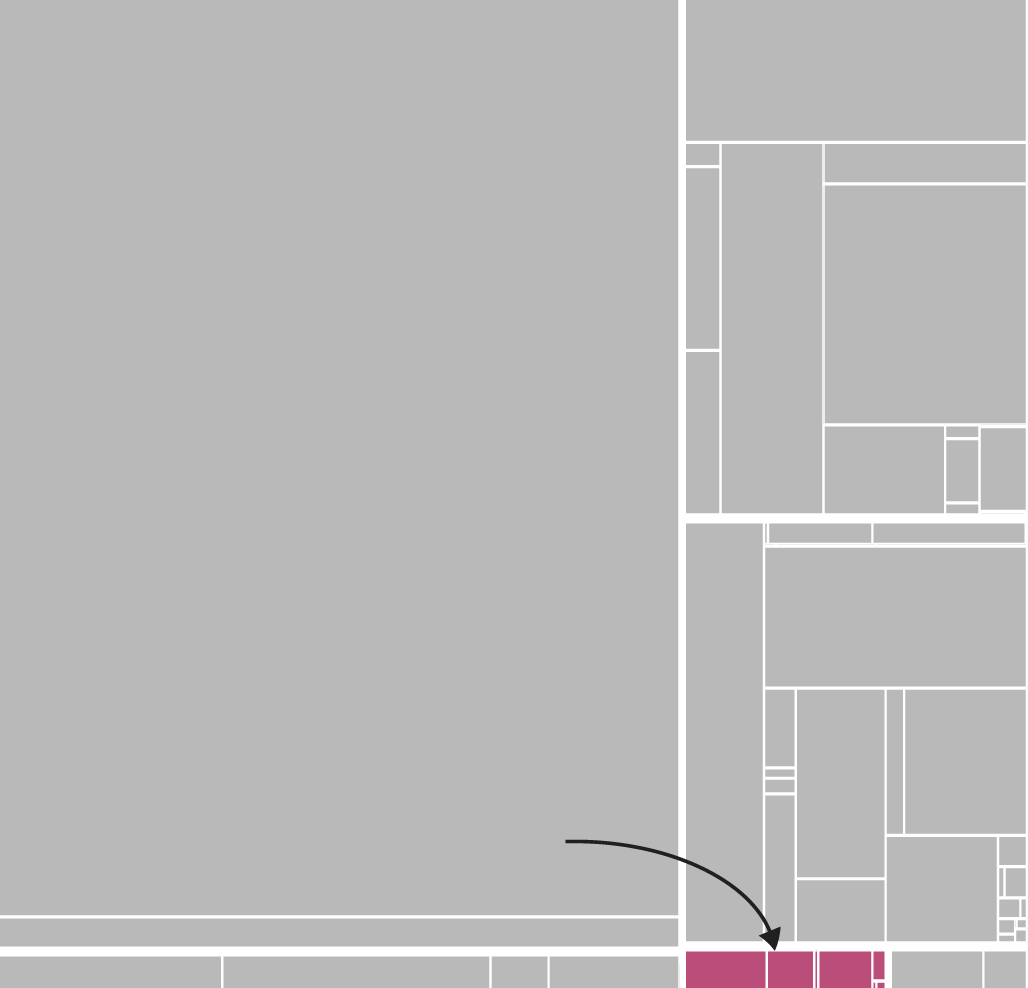

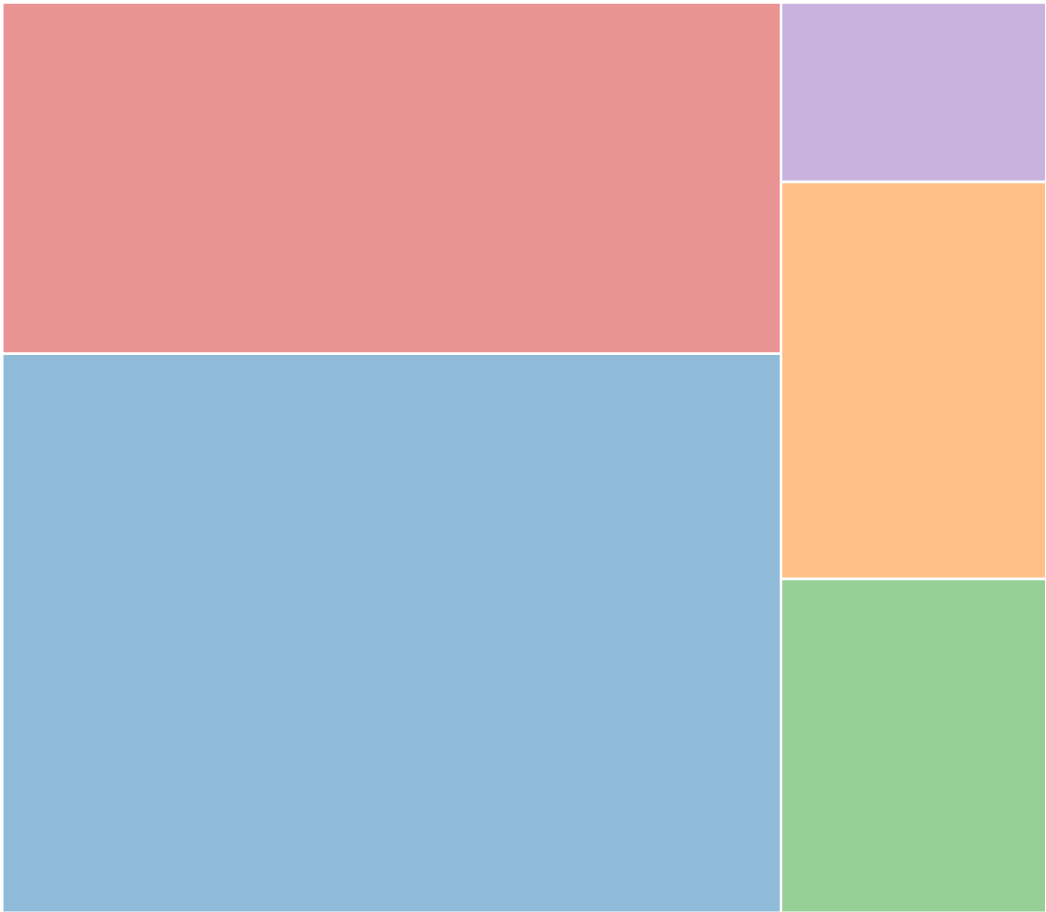

1. Only one percent of global agritech investment in Africa

$37.8 billion

Africa

$354.8m

$37.8 billion

Africa

$354.8m

Agriculture tech investment per capita

North America

40.1 %

Europe

7.3

Oceania

5.6

South America

2.4

Investment per capita shows

Oceania is way ahead of Africa

Asia

1.4

Africa

0.6

40.1 %

North America

Europe

7.3

Oceania

5.6

South America

Investment per capita shows

Oceania is way ahead of Africa

2.4

1.4

Asia

Africa

0.6

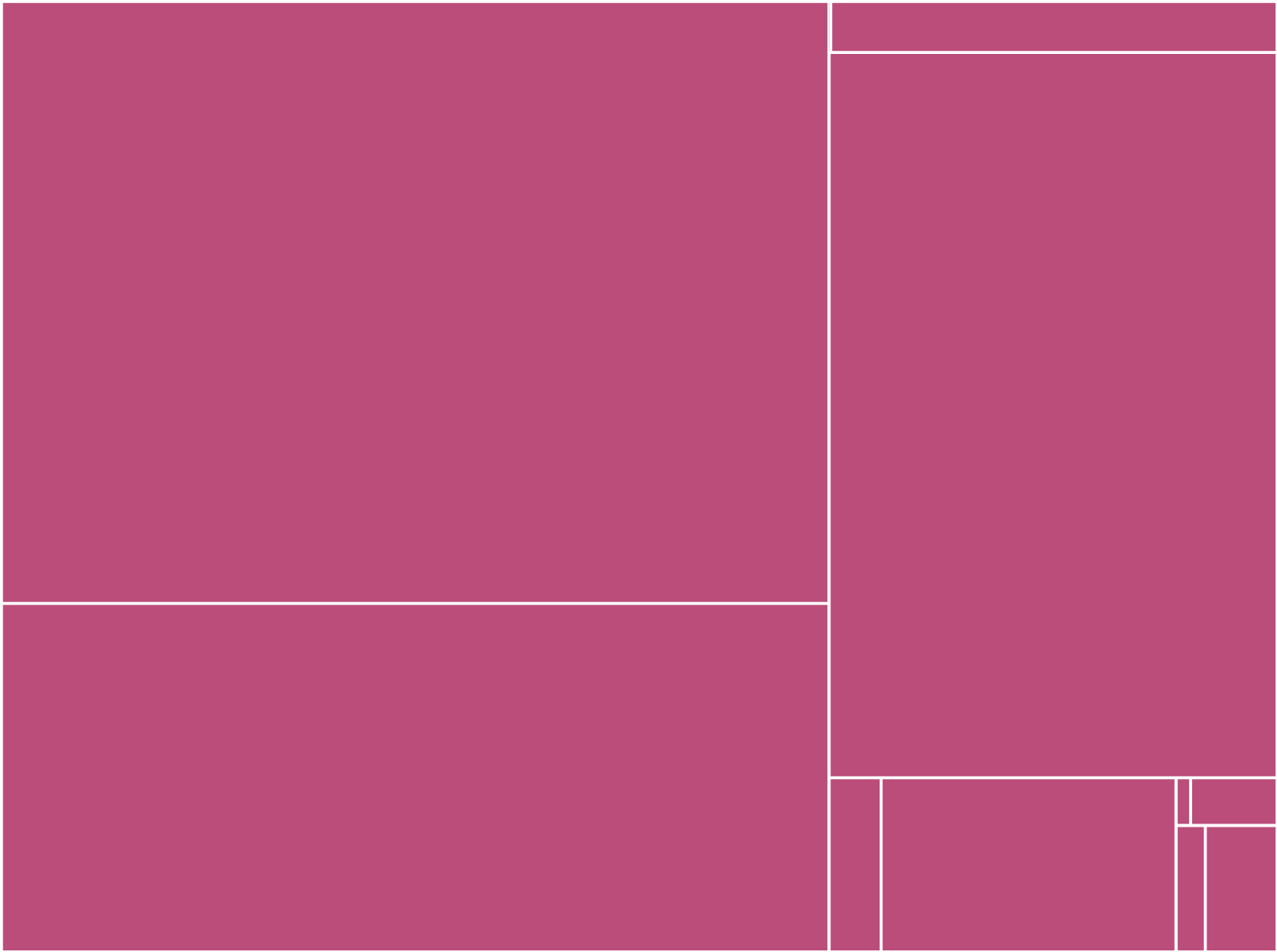

2. The top gainers of agritech investment in Africa

Ghana

$6.6 million

South Africa

Kenya

$145.6 million

$95.2 million

Nigeria

$84.3 million

Ethiopia

$15 million

Ghana

$6.6 million

South Africa

Kenya

$145.6 million

$95.2 million

Nigeria

$84.3 million

Ethiopia

$15 million

Most of the agriculture tech startups on the continent are based in the main economic hubs like South Africa, Kenya and Nigeria aided by a growing tech ecosystem.

3. Biotech is taking all the big bucks

Monitoring & Management

Packing & Supply

Chain

$10.9 billion

$1.9 billion

Business Planning

& Finance

$4.2 billion

Biotech

$17.3 billion

Distribution & Sales

$3.5 billion

Monitoring & Management

Packing & Supply

Chain

$10.9 billion

$1.9 billion

Business Planning

& Finance

$4.2 billion

Biotech

$17.3 billion

Distribution & Sales

$3.5 billion

Out of every $100 invested in agriculture technology startups, $45 go to businesses focused on biotech as the need to move the world towards sustainable food production systems expands.

But so far, Africa is missing out on this.

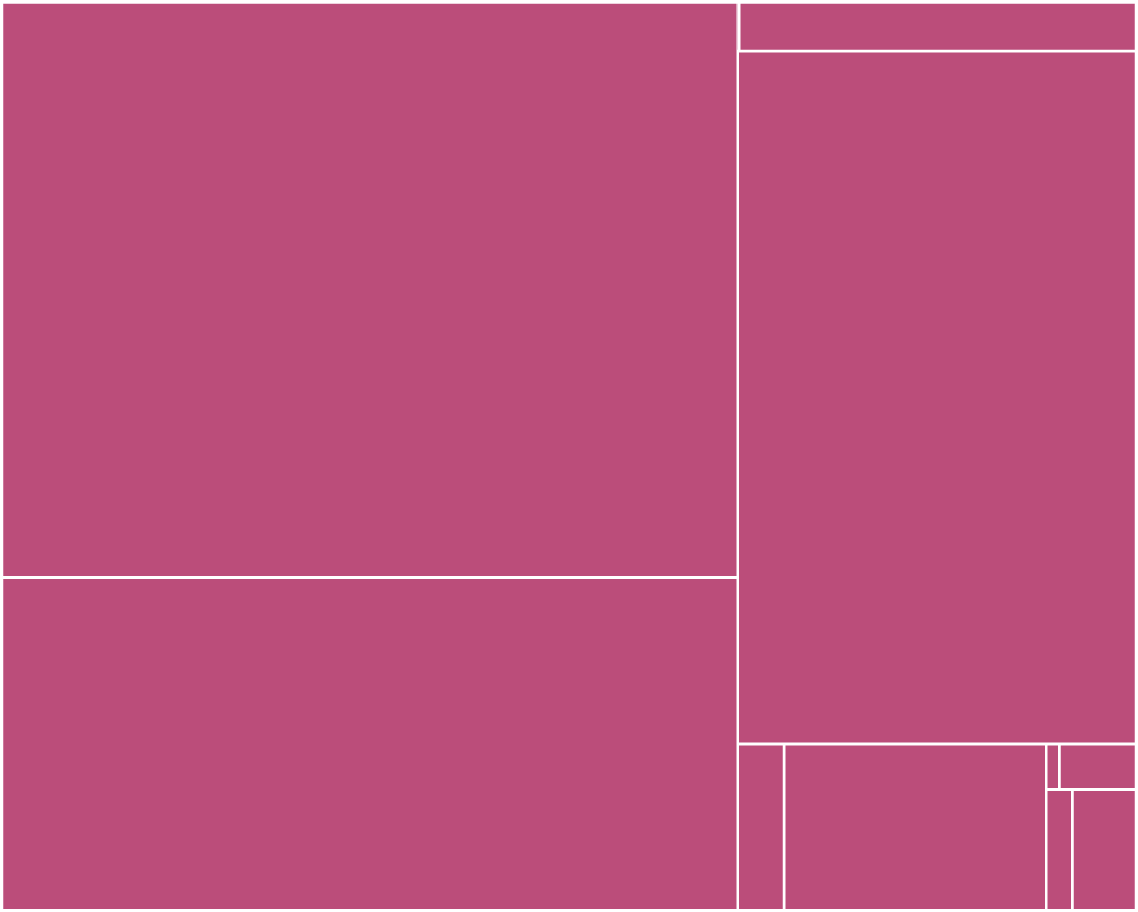

4. Where agriculture biotech investors took $17.3 billion

Asia

Europe

Oceania

$2 billion

$1.5

bn

$71.3 million

North America

$13.2 billion

South America

$541.6 million

Europe

Asia

Oceania

$2 billion

$71.3 million

$1.5

bn

North America

$13.2 billion

South America

$541.6 million

So far, North America, especially the U.S. has most of the global market share of agriculture biotech in its grips due to the barriers of entry that come with biotech businesses.

5. Where investors are putting their money in Africa

Monitoring & Management

Business Planning & Finance

$190.7 million

$148.9 million

$12.6 million

$3.5 million

Packing & Supply Chain

Distribution & Sales

Business Planning & Finance

Monitoring & Management

$148.9 million

$190.7m

$3.5 million

$12.6 million

Distribution & Sales

Packing & Supply Chain

Africa accounts for about 60 percent of global agriculture land. However, with advancement in biotech, it is unclear how much this would help to attract investments in the near future.

Find data analysis for this visualization here.